Why donate shares?

When you donate shares directly to a charity, by gifting assets that have appreciated in value, any capital gain will be effectively written off and no capital gains tax will arise. If you were to sell the shares first and then donate the proceeds, you would be liable for capital gains tax (CGT), which would reduce the overall amount available for donating. By gifting shares directly, both you and the charity benefit from the full value of the shares.

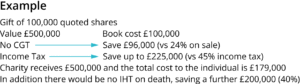

Tax benefits

There may be a number of potential tax benefits available to individuals by gifting shares to charity. In addition to the capital gains tax benefit already mentioned, the value of the gifts shared can be deducted against gross income in the tax year of gift reducing the income tax bill, even down to £0.

In addition, gifts to charity are exempt from inheritance tax (IHT) and immediately reduce the value of your estate for inheritance tax purposes.

Qualifying investments

You can gift a variety of shares to charity which qualify for tax relief, including shares and securities which are listed on a recognised stock exchange, Alternative Investment Market (AIM), units in an Authorised Unit Trust (AUT), shares in a UK Open-Ended Investment Company (OEIC) and holdings in certain foreign collective investment schemes. We recommend that you seek confirmation from a tax adviser that your investment qualifies for income tax relief. Tax experts at our sister company, Charter Tax, would be happy to advise.

Conclusion

At Ludlow Trust, we work with many clients to establish their own charitable trusts where they can maximise their charitable giving while making use of this valuable tax relief. Speak to one of our expert advisors about how we might be able to assist you with this.

Thursday 24th April 2025